Active asset management to generate opportunities and performance in a changing environment

The office buildings that were in vogue before the Covid period were large, single-tenant spaces. Six years on, the demand for office space has changed dramatically.

Office space remains a major tool in the economic fabric of our major cities and business parks. However, demand is changing, with more flexible use of office space following the spread of teleworking and the rise of the flex office.

The office is becoming a place for social interaction, collaboration and cultural anchoring for companies. Today, proximity to transport, access to services and the quality of life around the workplace have become as decisive criteria as surface area or rent.

Faced with this situation, it is not enough to adopt a passive asset management approach and wait for a favourable market return. We have adopted an active and dynamic asset management approach to turn this situation into an opportunity.

New office trends

The flex office, which means no longer allocating a fixed workstation, has emerged as a pragmatic response to the rise in teleworking and the need to optimise property costs. Companies are looking to rationalise their expenditure while offering their employees more collaborative environments: open spaces, flexible meeting rooms, concentration zones, etc.

Coworking spaces offer a modern working environment without the constraints of a long-term lease. This solution is attracting a growing number of companies keen to combine flexibility with cost control. The model is spreading to medium-sized towns and business districts, where users are looking for alternatives to traditional head offices. It is also tending to diversify, with sector-specific offerings: premium coworking, dedicated to the legal professions, creative professionals, etc.

Gradually converting office space into coworking spaces makes it possible to:

- Avoid vacancies and generate regular cash flow;

- Meet companies’ new needs for flexibility, both in terms of location and length of commitment;

- Add life to a building, making it more attractive to other tenants, particularly those on traditional leases.

Taking these developments into account, we have geared our new office acquisitions to generate maximum value by taking these market characteristics into account. In addition, to further improve the attractiveness of the offices held by the fund, a targeted CapEx policy will enable us to integrate this new paradigm.

A partnership that creates value

We have entered into a partnership with one of the world leaders in coworking (IWG), active through its five brands: HQ, Regus, Spaces, Signature and Stop&Work.

IWG will enable us to make contact with a wide range of these new office space users depending on their activities, the location of their assets and the quality of the premises.

This collaboration with IWG Régus, contracted through a management contract rather than a traditional lease, will enable us to benefit more remuneratively from Régus’ occupancy dynamics combined with meticulously studied site layouts. IWG Régus offers highly adaptable office space ranging from a single-person workstation to a dedicated space for teams of 15 to 20 people, targeting an increasingly important category of tenants. This partnership will enable Venture REF’s office spaces to position themselves favourably in response to a real market dynamic.

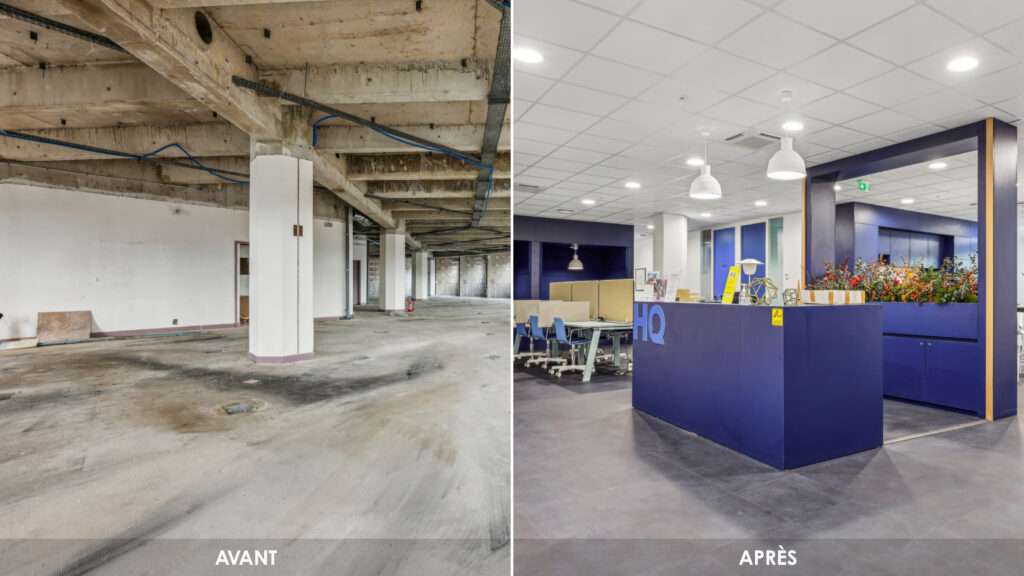

Illustration

At the end of 2024, IWG moved into our building in Noisy-le-Grand, occupying 1,500 m² on the 3rd and 4th floors, under a management contract. The Group operates the site and pays us the profits generated in return for refurbishment work. Discussions are underway to consider an extension to include a further floor. Other similar projects are being considered for several buildings, notably in Metz (1,700 m²) and Fontaine (1,100 m²). These openings are designed to improve occupancy rates, boost revenue streams and attract new investors.

This adaptation of our asset management strategy for office space is the result of an opportunistic approach characterised by active asset management. This strategy is based on measured capital expenditure which, combined with the partnership with IWG Régus, will enable us to return to attractive profitability in the short term and exceed the profitability of traditional fixed leases in the medium term. This is another illustration that explains the transition period that Venture REF is going through in 2025 in terms of its performance in order to prepare for the period 2026 to 2027.