Our investment

solutions

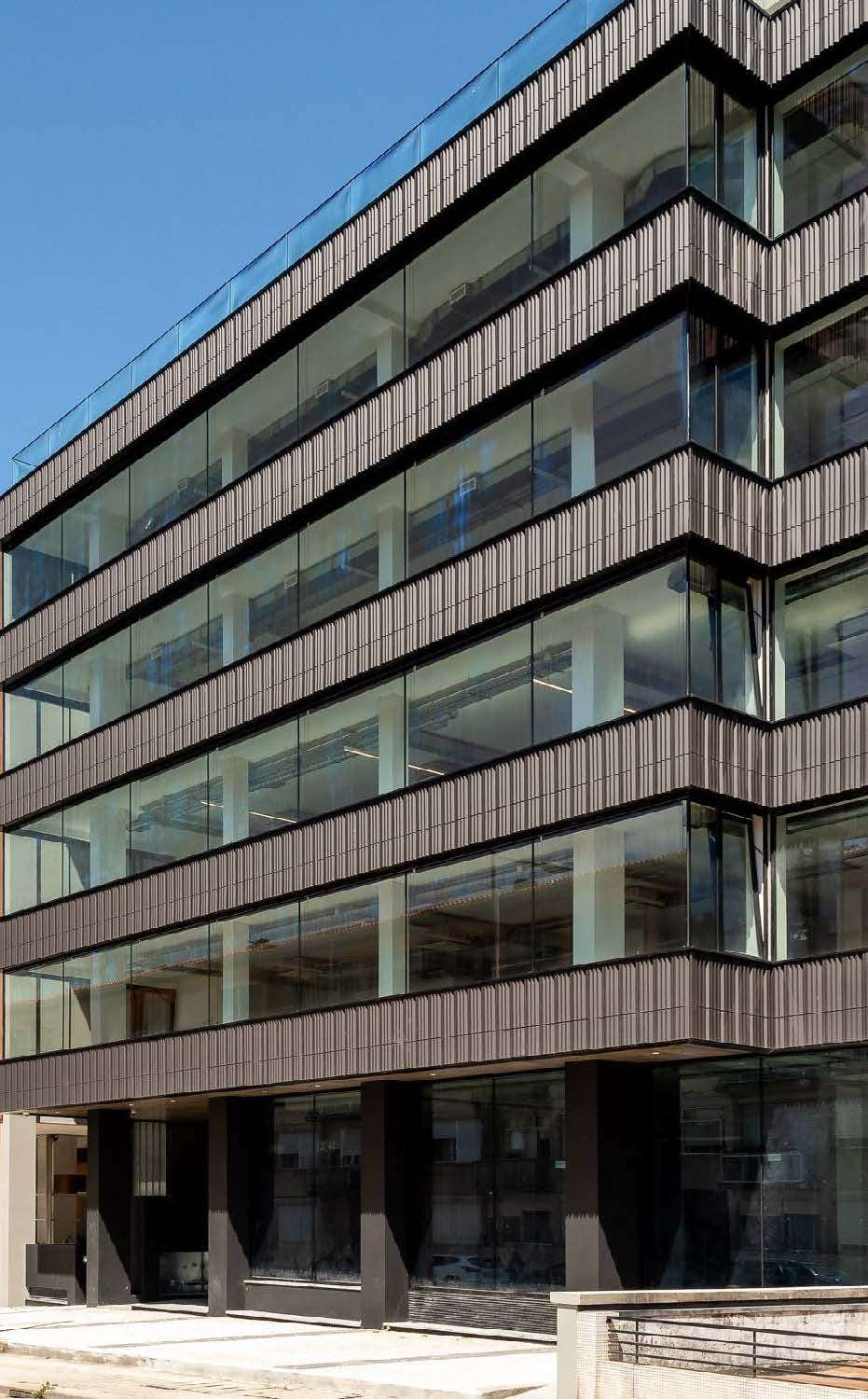

Venture Real Estate Opportunistic Fund

The multi-compartment pan-European opportunistic fund, the ideal tool to benefit from real estate market trends and achieve opportunistic IRRs over a fixed investment period.

Venture Real Estate Opportunistic Fund

Venture Real Estate Opportunistic Fund SCA SICAV RAIF is a Luxembourg professional fund exclusively intended for professional and/or well-informed investors according to the amended Luxembourg law of February 23, 2016.

The fund launched its first compartment in November 2023

The characteristics of Venture Real Estate Opportunistic Fund

A platform composed

of multiple compartments

Compartments

deploying an opportunistic strategy:

- acquisition

- value creation

- disposal

Closed-end compartments in 3 deployment phases:

- fundraising

- investment

- divestment

Targeting high IRRs

Seizing opportunities that generate IRRs of 8 to 11% over a period of 5 to 7 years.

Eligible Investors

Risks

Economic risks |

The real estate market remains subject to supply and demand requirements. Market fluctuations, as well as economic, political and social conditions, can influence the value of physical assets, both upwards and downwards; | ||

Liquidity risk |

The liquidity conditions, specific to physical real estate assets, may require a certain period of time before a disposal operation can be carried out. Therefore, significant redemption requests for more than 5% of the fund’s units could be temporarily suspended. | ||

Financing condition risks |

The use of bank financing to fund part of the acquisition price of properties subjects the fund to variations that can affect its performance. Changes in financing conditions may concern the level of interest rates, the proportion of equity required by the bank, etc. | ||